Freelance Income

An income arising from any profession that involves any particular skill set (intellectual or manual skill) comes under purview of Tax, under the head Profit & Gain of Business and Profession. This clarifies that any freelancing income is subject to Tax.

GST replaces VAT and Service Tax applied on Freelancers

Define GST

Goods and Services Tax, also known as GST, is a composite tax. This tax system replaces all other kind of taxes. The GST tax is also applicable on service industry.

What is the GST rate on products sold / services offered?

The rate of GST depends on the product sold & services offered. Here’s a handy book for you to refer.

For Freelancers, the GST rate is 18%. This means a freelancer would charge 18% on the total bill amount for the services provided to the clients (when exceeding the exemption limit of Rs. 20 lacs anually).

Is GST Registration Mandatory for All Freelancers?

This is an important and recurring question. Here’s to clarify:

GST Registration is applicable to any freelancer providing services like content writing, graphic designing, website development or any other kind of freelance digital services, if the annual turnover of a freelancer is more than Rs. 20 lacs.

Also Read: Inter-state supplies of up to Rs 20 lakh allowed without GST registration

GST registration can be done from here.

Should a freelancer charge GST from overseas clients?

No. You need not charge GST to foreign clients. Payments from Foreign Bank Account or through PayPal do not require a payment of GST.

How many GST fillings does a freelancer need to make?

If you’re registered under the GST, you need to file 3 returns each month and one annual return. In total, you’ve to make 37 returns (3X12+1=37).

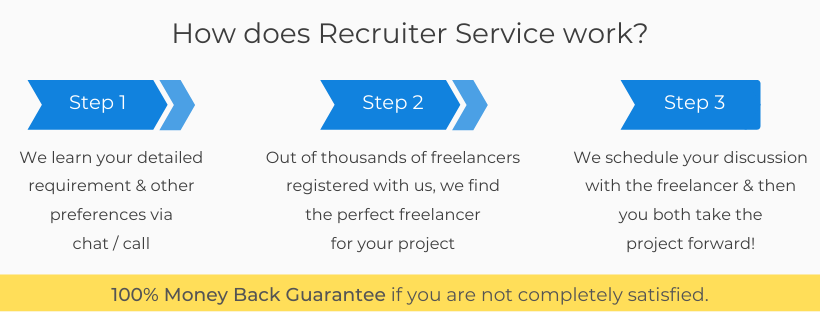

Sounds like an uphill task? Make it simple by seeking a professional help and file the returns on time. You can easily hire a professional CA on dolancing.com platform.

Does GST affect the overall income of a freelancer?

Well, the good news is GST doesn’t affect the income of a freelancer. The tax amount is to be borne by the client, so you need not worry. :)

Conclusion

The idea behind the GST is to bring all businesses including freelancing under a single tax regime, whether they deal in goods or services. In the beginning, GST on freelance earning may sound deterring, especially to newbie freelancers or even well-established ones, but in the long run, it will help you to pursue a full-time career in freelancing. If you are thinking of being a full-time freelancer, you cannot evade it. The rules may change in coming time, but don’t worry for that matter. We’re here to keep you updated.

Stay Tuned!

NOTE: The aim of this blog is to assist you & keep you informed about the GST & it's affect on your freelance earning. The provided information is to the best knowledge of the writer. We suggest you to seek professional help for any further assistance & queries while consolidating.